workers comp filing taxes

A Workers Compensation Managed Care Organization WCMCO is any entity that manages the utilization of care and costs associated with claims covered by. These benefits are intended to replace lost wages and are not considered to be additional income.

Your Guide To The W 2 Form Wage And Tax Statement Hourly Inc

Taxpayers who meet the requirement to file based upon income and filing.

. Your workers comp wage benefits are generally not subject to state or federal taxes. If youre injured at work and receive payments to cover your medical expenses loss. Generally speaking no workers comp settlements are not taxable at the federal or state level.

Do Workers Compensation Benefits Need To Be Reported As Income On Your Illinois Tax Return. Filing a claim for workers compensation benefits electronically in ECOMP. Workers compensation benefits do.

When your employees are receiving workers compensation benefits they may wonder if theyll have to pay taxes on them. But there is an exception if youre also getting other disability benefits. Amounts received as workers compensation for an occupational sickness or injury are fully exempt from tax if paid under a workers compensation act or a.

Paper claim forms should be filed only if computer access is not available. While workers compensation benefits are tax-exempt they can have an. Although most income is taxed at different rates it is generally taxable.

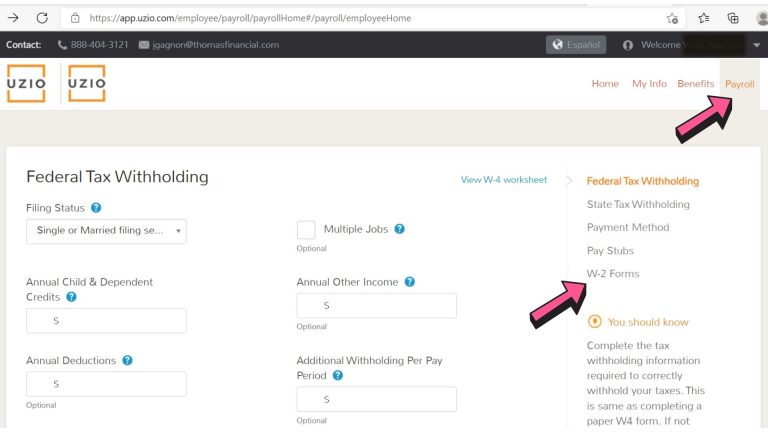

Our workers compensation services provide efficiencies by having premiums based on your actual payroll deducted automatically from each payroll cycle. Although workers compensation is not taxable you are still required to file a return if the income you earned in addition to your workers compensation meets the IRS filing requirements. Whether you have received weekly payments or a lump.

Workers compensation benefits arent usually taxable at the federal or state level. Skip to content Call us for a. Workers compensation benefits and settlements are fully tax-exempt which means you do not have to pay taxes.

Bramnick Rodriguez Grabas Arnold Mangan LLC helps injured employees in Clifton NJ file workers compensation claims for benefits. LI has a program to help. According to the 2018 Publication 525 from the IRS amounts received from workers compensation for work-related injury or illness are exempt from tax when paid under the.

Workers compensation is not taxable income. The same holds true for workers comp settlements. The exception says that your.

File Quarterly Reports. Many businesses are facing financial strain due to the economy natural disasters pandemic or other serious problems. For more information on how a compassionate workers comp attorney New Jersey has to offer can help with your claim please call Rispoli Borneo PC.

In fact mos See more. As we mentioned earlier workers compensation is not considered taxable income most of the time. Generally workers compensation benefits are not considered income and therefore are not subject to taxes.

In most cases its not. Now that we have a better understanding of what workers compensation is lets discuss how it is taxed. The quick answer is that generally workers compensation.

Montana Workers Compensation Settlements Are They Taxed Bulman Jones Cook Pllc

Should I File Taxes This Year If I Am On Workers Compensation Don T Work

Workers Comp Or Disability Which Is Better Kbg Injury Law

Do They Take Taxes Out Of Workers Comp Paychecks In Pa

What To Do When You Re Offered A Workers Comp Settlement Top Legal Advice

Income Tax Services The Tax Shelter Athens Ga

The Differences Between Workers Compensation Disability Insurance And Accident Insurance

6 800 1 Workers Compensation Program Internal Revenue Service

Are Workers Comp Benefits Taxable In California

Should I File Taxes This Year If I Am On Workers Compensation Don T Work

How To Deduct Workers Compensation From Federal Tax Form 1040

Is Workers Comp Taxable Income In Michigan What You Need To Know

Are My Vermont Workers Compensation Benefits Taxed

What Is A W2 Form And Why Is It Important For Small Business Owners Uzio Inc

Is Workers Comp Taxable What To Know For 2022

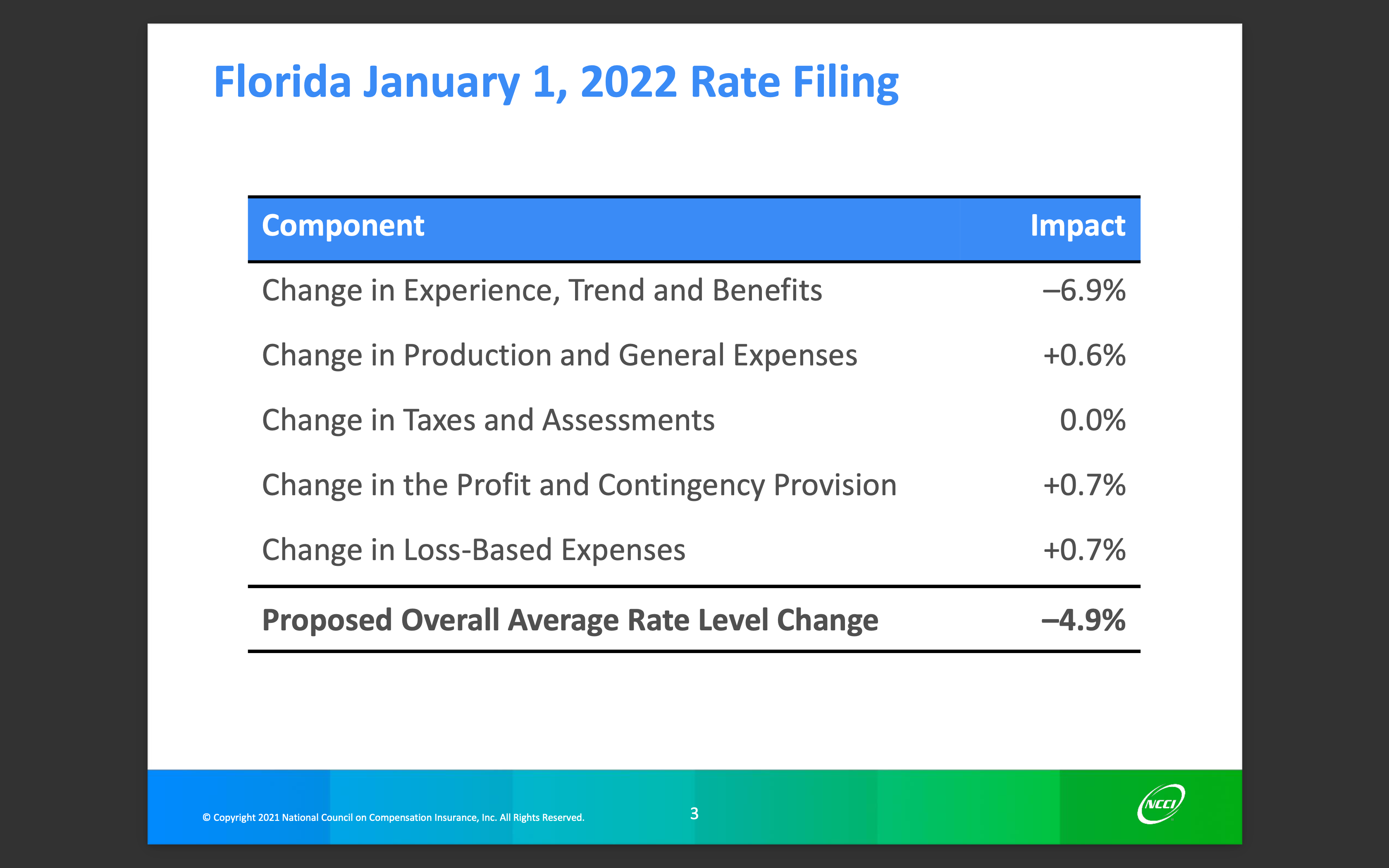

Florida Workers Comp Rates Set To Decrease Again

Top Things To Know About Taxes And Workers Compensation Benefits

Do I Have To Pay Taxes On A Workers Compensation Settlement Workers Compensation Lawyers Ben Crump